In This Article

- Tariff Uncertainty Causing the ASML Stocks to Go Down

- How Tariffs are Making a Change in ASML Stocks

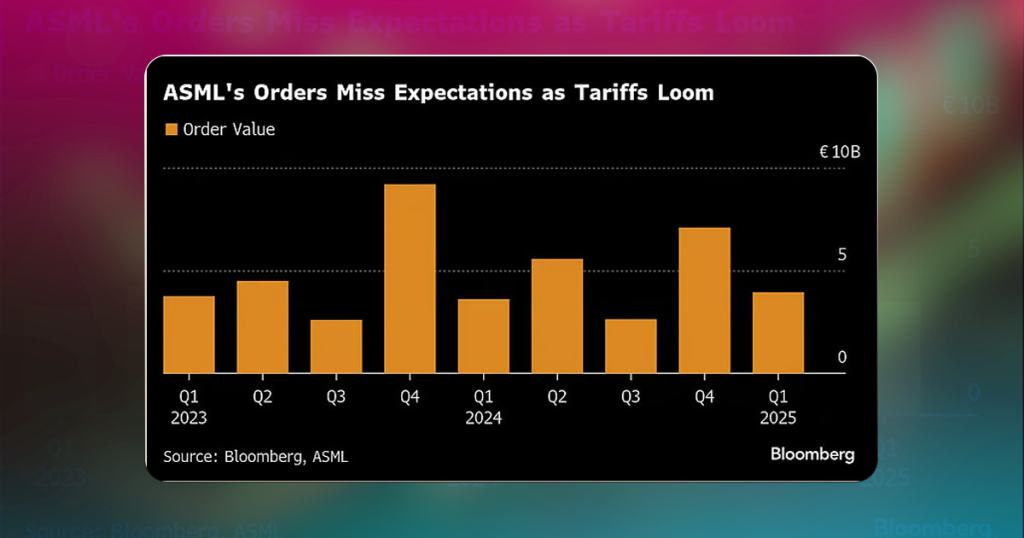

ASML is a Dutch multinational corporation and the world-leading supplier for the semiconductor industry. It provides hardware, software, and services to the chip-making companies and has great value in the stock market. Although on April 15, its first quarter 2025 report was published, showing the company has plunged 8.6%.

Not only this, but several other technical companies are facing the same issue, and the reason is the slower booking growth of the products and tariffs announced by the Trump administration, which are leading to the issue of escalating Chinese trade restrictions.

In these conditions, the investors are confused about whether to exit the investment or take it as a buy-the-dip opportunity. The company has plans for the upcoming years, but this situation is causing the delay or termination of the big projects, depending on the investor’s decision.

Tariff Uncertainty Causing the ASML Stocks to Go Down

On Wednesday, the world’s biggest chip-making supplier company said that the tariffs are the main reason for spreading the uncertainty in the company’s stock position and its plans for the years 2025 and 2026.

The CEO, Christophe Fouquet, was discussing ASML’s expectation for the years 2025 and 2026, saying these were considered the growing years for the company, but things are different now:

However, the recent tariff announcements have increased uncertainty in the macro environment

ASML is doing great business nowadays after the advancement in artificial intelligence, but recently, the tariff load has affected businesses working at every scale.

The CEO also said:

The burden of tariffs, from our vantage point, should be allocated in a fair way. We think that those taking it in the United States should, therefore, take the lion’s share of that allocation.

The company has a plan to send the tariff burden directly to the clients. The tariffs are directly influencing the semiconductor industry, and the United States is targeting the semiconductor industry the most for the tariffs. On Sunday, Trump said he is going to make the announcement about this topic this week.

According to the Trump tariff plan, 10 percent tariffs will be applied to all global imports to the United States. Moreover, the administration is pausing the higher duties for good from the European Union and a dozen other useful countries, making a huge business for the United States.

Although the tariffs are high, ASML is working well in the semiconductor business because it is working on making semiconductor AI chips. We know that artificial intelligence is transforming the whole world, and its use in every field makes the AI chips work so crucial.

Similarly, integrating the AI features into the web solutions makes them flawless, efficient, and interesting, with more profit. Therefore, at Weborik Hub, we are ready to integrate the AI features into your websites and web apps to make them better than ever.

How Tariffs are Making a Change in ASML Stocks

After all these announcements, the experts took an estimate of the effects of tariffs on the semiconductor industry. In only US, tariffs could cost more than $1 billion to the semiconductor industry in just one year, and these figures are shared by the official platform.

The semiconductor chips and other parts from ASML pass through multiple continents back and forth for transport between the continents. Dassen suggests free trade between these zones to make the transport easy and convenient.

The tariffs from the Trump administration are imposing heavy tariffs around the world, and tech companies like ASML are most influenced by these decisions. Although it is affecting the business, being the AI chip-making company, the company was expecting a good business in 2025 and 2026, but the tariffs have caused a balance situation, so the company is in a middle position for the business year.